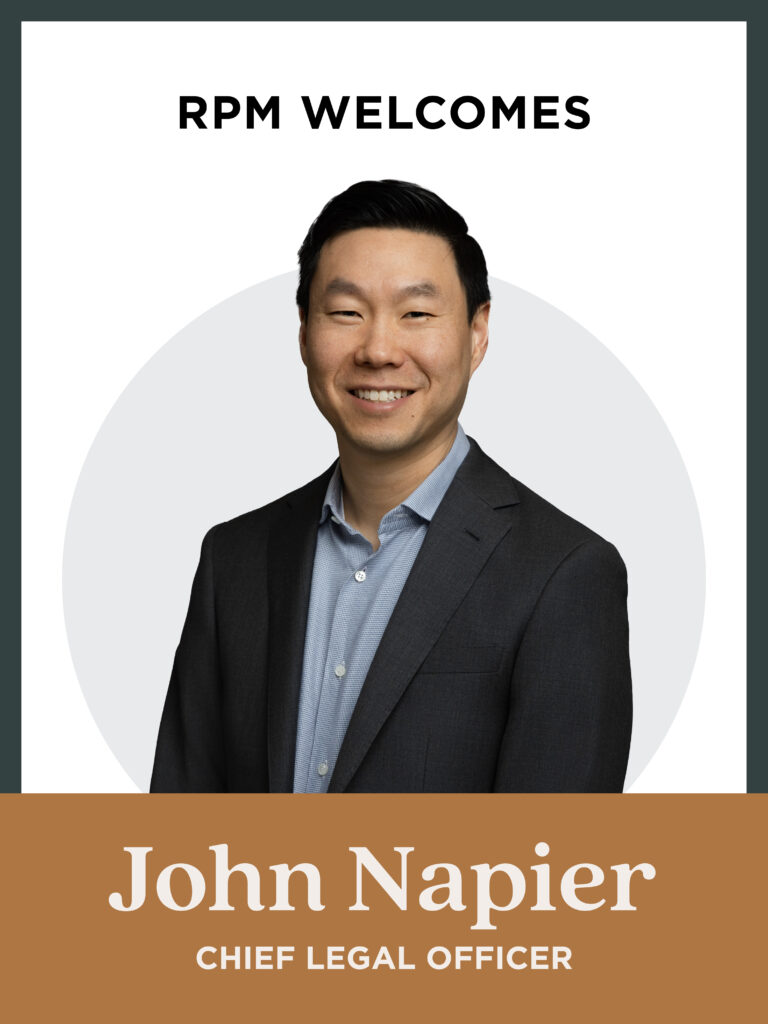

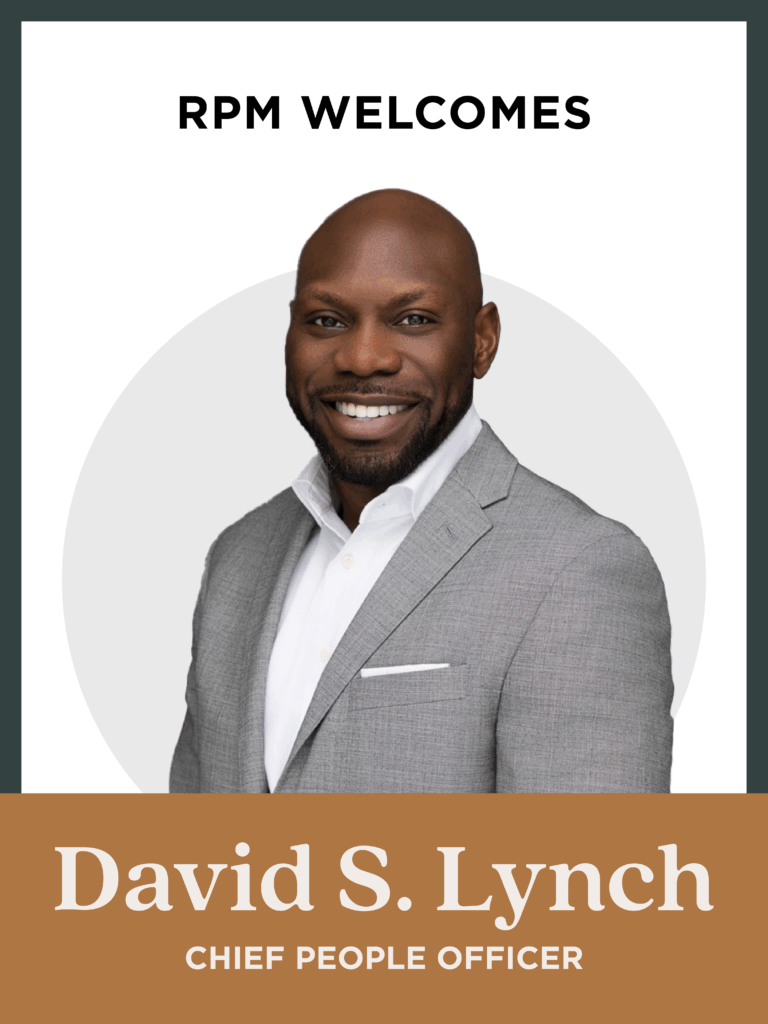

We’re excited to welcome David S. Lynch, Chief People Officer, to the RPM Living team! With nearly two decades of experience at The Ritz-Carlton and The Ritz-Carlton Leadership Center, David brings a wealth of knowledge in hospitality and leadership. His passion for creating meaningful, human-centered experiences aligns seamlessly with RPM’s vision “to be a place where extraordinary people thrive.”

As Chief People Officer, David will focus on embedding a culture of excellence across RPM, supporting both our associates and residents, and helping RPM continue to redefine what extraordinary looks like in multifamily. We sat down with him for a Q+A to learn more about his journey, what excites him most about RPM, and the leadership values he brings to his new role

RPM: From your hospitality experience, what are you most excited to bring to RPM?

David: One of the things I’m genuinely thrilled about is bridging the incredible parallels between hospitality and property management. Hospitality, at its core, is about making meaningful, human connections and elevating everyday experiences, no matter what industry you’re in. For RPM, I’m excited to bring that mindset of high-touch, high-quality service into our everyday culture.

What excites me most is really embedding that customer experience DNA into RPM Living’s Vision, “To be a place where extraordinary people thrive.” Having spent 18 years with The Ritz-Carlton and most recently with The Ritz-Carlton Leadership Center, I’ve learned that excellence is really about consistency—delivering high-quality experiences day in and day out. It’s about setting a standard where everyone is aligned to that level of consistency and excellence.

We have this wonderful opportunity to not just manage properties, but to create a truly distinctive, human-centric experience for every resident and employee. I want to help RPM become a true industry disruptor in how we engage our residents, shape career pathways for our team members, and develop leaders who genuinely prioritize quality and care.

In short, in an industry where success is often measured by unit count, I’m eager to underscore that RPM is dedicated to creating meaningful, memorable experiences that make each day a little brighter for the people we serve.

RPM: What are a couple of things you’ve learned about RPM in your first few months?

David: One of the biggest things I’ve learned is just how many key players really bring RPM’s culture to life. It’s been a privilege getting to know the organization through my travels, whether I’m sitting down with maintenance technicians, leasing associates, community managers, or our senior leaders. There’s this common thread of an organic, people-focused culture that’s all about making a real difference in every role.

I’ve discovered that RPM has this unique ability to give each region that boutique, almost startup-like feel. It’s not just about hierarchy; it’s about how every individual, whether they lead by title or by example, can innovate and improve how we do things. That’s been one of the most inspiring layers to unfold; seeing how everyone’s passion for excellence drives us forward.

I’ve also learned how much our people choose to be here and bring the best of themselves every day. It’s a place that blends different experiences, whether through acquisitions or people coming from other backgrounds, and creates a shared sense of commitment to being the best. That’s the kind of energy that makes these first few months so rewarding.

RPM: What attracted you to RPM?

David: I have to say that joining RPM was as much a delightful surprise to me as it might have been to some of the folks who worked here. I started out working with RPM as an external consultant for about six months, and during that time, something just clicked.

What really drew me in—beyond the incredible people—was the organic culture rooted in growth, innovation, and a sense of flexibility that makes you feel part of something bigger. And yes, it was a bit of a plot twist for me too! In fact, I went skydiving right after accepting the offer as a way to symbolize that leap of faith.

But once the opportunity came up, it just felt right. I wanted to be part of something magical, something that felt bigger than myself. I believe deeply in Jason’s vision for RPM and the idea that we can truly redefine what multifamily property management means. It’s not just about numbers; it’s about the quality of our experiences, the growth of our people, and being absolutely the best at delivering for our residents and clients. And that’s something I knew I wanted to be a part of.

RPM: What do you see as the biggest opportunities ahead for RPM and your team?

David: One of the biggest opportunities I see is that RPM already has all the pieces to the puzzle. We have everything we need to achieve truly unparalleled operational success and redefine how this industry approaches customer experience.

But the real opportunity ahead is about connecting those pieces and making them work seamlessly together. I see my role, and my team’s role, as the ultimate dot connector. It’s about breaking down silos, creating that high-level synergy so that every department is working in harmony. It’s a bit like a relay team, and to quote Captain Planet, “with our powers combined,” we’ll deliver the extraordinary experience we’re aiming for.

I see our team as that Olympian-style support network that ensures every stage of the employee lifecycle, every piece of the associate experience, and every element of our performance metrics are aligned. It’s about making sure we pass the baton smoothly from one area to another, never dropping it, and ultimately becoming the star team we know we can be. I can’t wait to bring all those elements together.

RPM: Outside of work, what are a few things that inspire or motivate you?

David: My biggest inspiration is my parents. I’m the youngest of four boys, and growing up, I watched my parents work tirelessly to give us not just a strong sense of family, but also the freedom to be authentically ourselves. They always made sure we knew we weren’t just meeting standards—we were setting them. Seeing how they led by example, how they pivoted, created, and remained gracious through every part of their lives has been a huge motivator for me.

They taught me that “can’t” isn’t in our vocabulary and that there’s always a way forward if you’re willing to find it. They showed me the importance of conflict management, finding the middle ground, and creating wins for everyone involved. Now that they’re retired, they’re not just my parents—they’re my friends and trusted advisors. And I carry those lessons of nurturing, caring, and that sense of connectedness into everything I do.

I’m also deeply inspired by seeing people strive to be their best and help others without expecting recognition. It’s that human connection, that sense of community and growth, that really motivates me day in and day out.

RPM: If you had one piece of advice for associates across RPM, what would it be?

David: My advice would be simple: buckle in, because this is going to be the ride of a lifetime! We have an incredible opportunity right now to do something in this industry that’s truly above and beyond anything anyone has seen before. It’s going to be exhilarating, it’s going to be transformative, and yes, it’s going to be a change. I’m a realist, so I’ll say it might not always be easy, but if you’re here at RPM at this moment, you’re part of something incredibly special.

You have the chance to shape the future of this organization, to set new standards in the industry, and to create your own path for growth. The sky’s truly the limit for us, and I wholeheartedly believe that. So, buckle in and get ready for an amazing journey.

RPM: What leadership qualities do you value most, and how do you try to model them in your role?

David: The leadership qualities I value most are authenticity, communication, connection, and collaboration. For me, it’s about being a leader who brings out the best in people, who supports their professional growth, and who understands that personal growth is part of that journey too. I want my team to know they’re fully supported every step of the way, even on the tough days, and that we’re truly in it together.

I try to model these qualities by being a collaborator and having meaningful conversations with my team. I believe feedback is a gift, so I always aim to listen, act on that feedback, and create a culture where people feel heard. Ultimately, I want to be the kind of leader that my team looks back on years later and feels that my leadership had a positive, transformative influence on their careers and their lives. And I hope they leave work at the end of the day feeling that positivity, carrying it into their own worlds.

RPM: What’s your favorite leadership book, and why does it resonate with you?

David: One of the leadership books that really stuck with me is Good to Great by Jim Collins. It was pivotal early in my career and still resonates with me today. The whole idea that good is the enemy of great is something that I find incredibly motivating. It reminds me that we shouldn’t settle for just being okay or just meeting the status quo—we should really strive for excellence and set the standard.

Collins talks about the concept of Level 5 Leadership and the idea of getting the right people on the bus, which really resonates with how I think about building teams and transforming organizations. There’s a quote in the book that says, “Great vision without great people is irrelevant,” and that’s something I carry with me. It’s about transforming not just how we present ourselves as a brand, but how we live it in our daily actions; how we show up, make an impact, and push ourselves toward greatness. That book really reinforced my belief that we can always leap from good to great, and that excellence is less a destination and more a journey we commit to every day.

Take me back to the latest News & Press